tennessee inheritance tax laws

Tennessee and Federal Estate Tax Exemptions Raised Today for 2014. The inheritance tax is no longer imposed after December 31 2015.

Is Your Inheritance Considered Taxable Income H R Block

Next year it will increase to 500000000 and then it will be abolished in 2016.

. With a probate advance otherwise referred to as an inheritance cash advance you can receive funds immediately you can call us and we can have your cash to you within 24-72 hours with a stress free and considerate process. The net estate less the applicable exemption see the Exemption page is taxed at the following rates. The Federal estate tax only affects02 of Estates.

Ad Solve Your Legal Problems w Help from Certified Real Estate Lawyers in Minutes. Due Date and Tax Rates. The Federal inheritance tax exemption for 2014 was raised to 534000000 today.

Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply.

Today the Tennessee inheritance tax exemption for 2014 is raised to 200000000. All inheritance are exempt in the State of Tennessee. What Tennessee called an inheritance tax was really a state estate tax that is a tax imposed only when the total value of an estate exceeds a certain value.

Here is the breakdown on the exemptions for each year starting in 2006. The inheritance tax is due nine months after death of the decedent. State Inheritance Tax Return Long Form Please note that schedules A through O listed under other forms must be attached to the completed long form.

In 2012 Tennessee passed a law to phase out the estate or inheritance tax over time. Consent to Online Transfer. Instructions for State Inheritance Tax Return.

Tennessee does not have an inheritance tax either. In Tennessee the intestate succession laws are. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death.

Tennessee has updated its tax laws recently regarding both its inheritance tax and gift tax. Details on Tennessees. If a decedent had a spouse and descendants all parties share the assets equally but the spouse must get at least one-third.

In January of 2016 Tennessee repealed its inheritance tax to encourage residents to continue to live and retire within the state. The inheritance tax applies to money and assets after distribution to a persons heirs. In 2016 the inheritance tax will be completely repealed.

Technically Tennessee residents dont have to pay the inheritance tax. The only situation where this tax might be owed is if a person died before 2016 and left a highly valuable estate that has not been probated. Please DO NOT file for decedents with dates of death in 2016.

What is the inheritance tax rate in Tennessee. However it applies only to the estate physically located and transferred within the state between Tennessee residents. There is a single exemption against the net estate of a Tennessee decedent in the following amounts depending on the year of the decedents death.

If a decedent had a spouse but no children or grandchildren the spouse takes everything. In May 2012 legislation was enacted which will phase out the Tennessee inheritance tax by 2016. How do the inheritance and estate tax laws work in Tennessee.

Publications and Other Resources. In 2012 the Tennessee General Assembly chose to phase out the states inheritance tax over a period of. Until that time estate administrators must continue to file the appropriate returns and pay the required estate taxes if the estate is larger than the amount of the exemption.

If a decedent had children but no spouse the children take everything. However there are additional tax returns that heirs and survivors must resolve for their deceased family members. 11 rows Inheritance Tax.

If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. Since the Tennessee legislative code refers to both an inheritance tax and an estate tax this article refers to the death tax that is currently collected under Tennessee law as an inheritance tax even though the tax is assessed against the assets located in Tennessee and not against the individual beneficiaries who inherit the estate. For example the neighboring state of Kentucky does have an inheritance tax.

Up to 25 cash back Tennessee Terminology. There are NO Tennessee Inheritance Tax. Inheritance Tax in Tennessee.

Inheritance taxes in Tennessee. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative. Complete Edit or Print Tax Forms Instantly.

Ad Access Tax Forms. IT-2 - Inheritance Tax Overview. Select Popular Legal Forms Packages of Any Category.

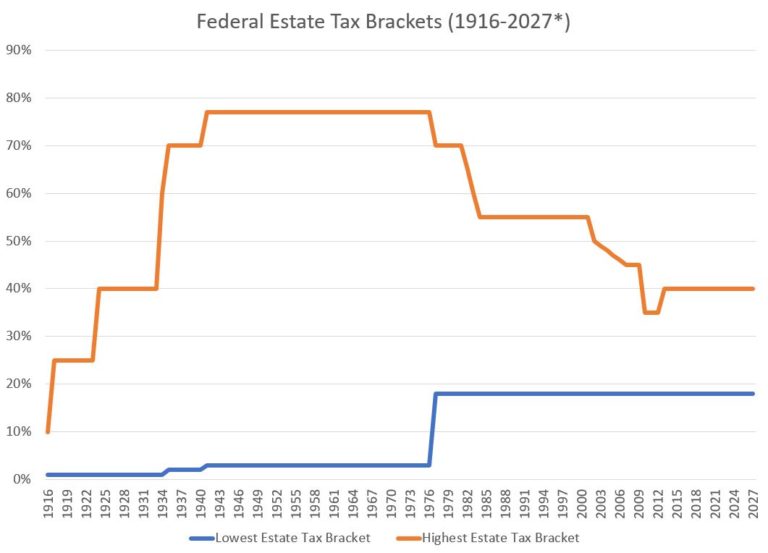

Tennessee Inheritance and Gift Tax. However if the value of the estate is over the exempted allowance for a particular year the tax rate ranges from 55 at the lowest end to 95 at its highest end. The inheritance tax is different from the estate tax.

Tennessee is an inheritance tax-free state. For example the state of Tennessee does not follow strict community property inheritance laws which means you must be careful when it comes to creating an estate plan. As mentioned previously the probate process in Tennessee typically takes anywhere from eight months to three years to.

All Major Categories Covered. For nonresidents of Tennessee an estate may be subject to the Tennessee inheritance tax if it includes real estate andor tangible personal property having a situs within the state of Tennessee and the gross estate exceeds 1250000. There is a chance though that another states inheritance tax will apply if you inherit something from someone.

We hope the following information provides some basic information about Tennessees inheritance and gift taxes. Download Or Email TN INH 302 More Fillable Forms Register and Subscribe Now.

What S In A Name Part 2 Tax And Other Consequences Caused By Joint Ownership Of Real Property Sgr Law

11 Estate Taxes And Inheritance Planning Faqs Taxact Blog

Do You Need A Tax Id Number When The Trust Grantor Dies Probate When Someone Dies Last Will And Testament

States With An Inheritance Tax Recently Updated For 2020 Jrc Insurance Group

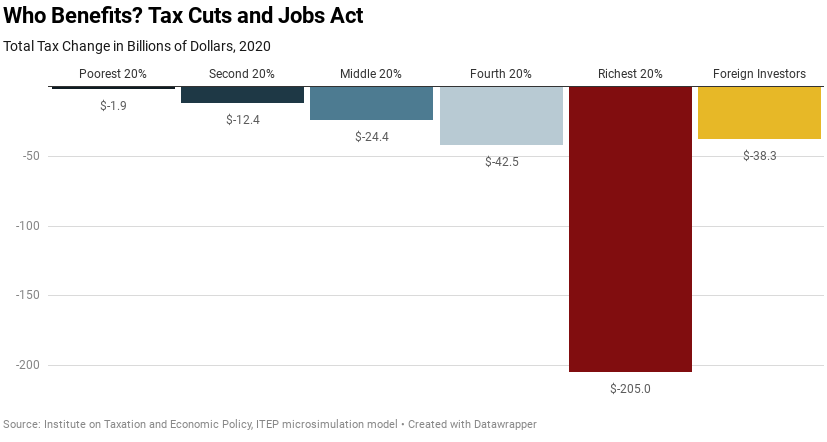

Updated Estimates From Itep Trump Tax Law Still Benefits The Rich No Matter How You Look At It Itep

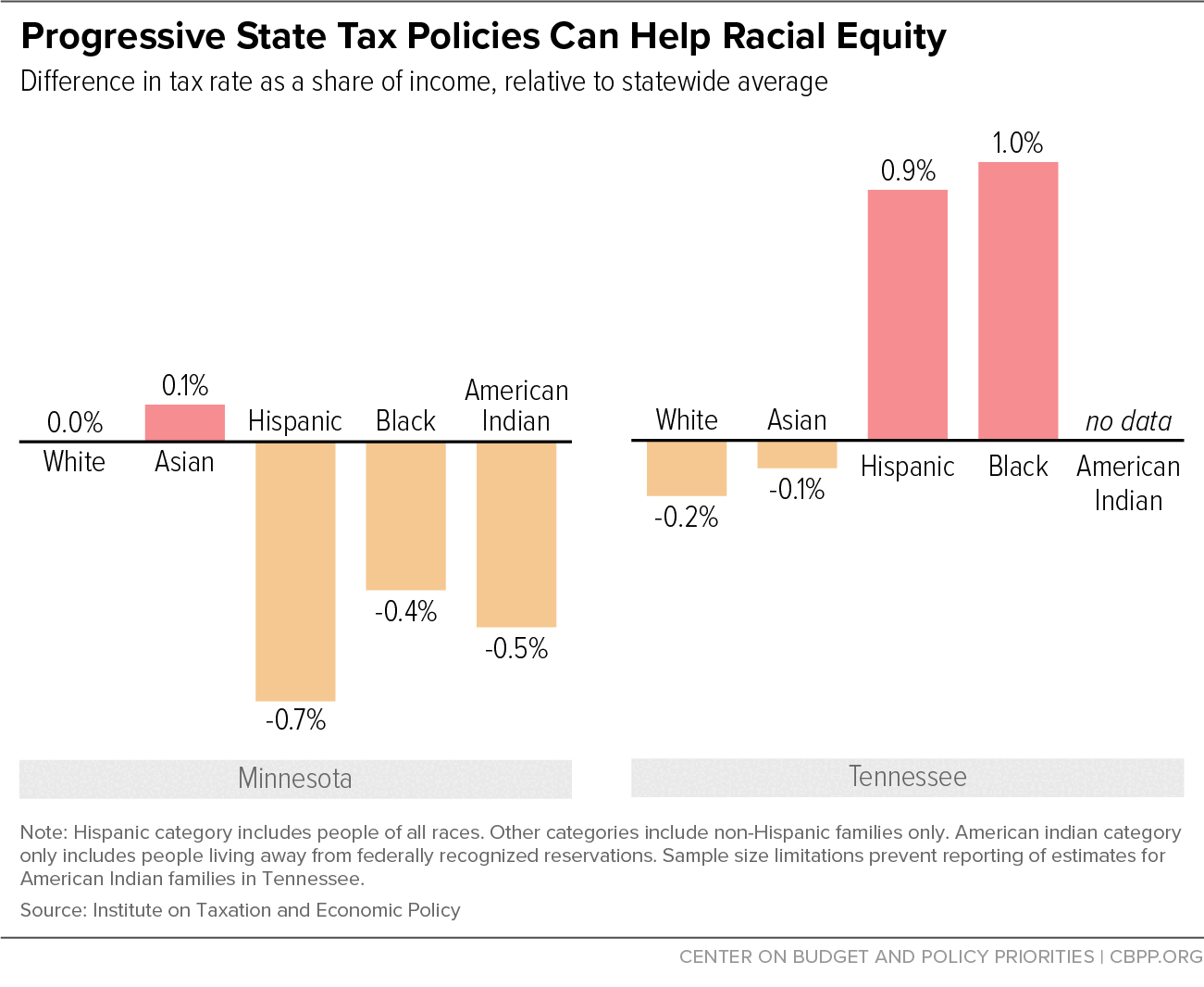

States Can Create Antiracist And Equitable Tax Codes Center On Budget And Policy Priorities

How To Financially Protect Your Unmarried Partner In 2022 How To Plan Estate Planning Common Law Marriage

What Are Estate Taxes And How Will They Affect Me Wallstreet Siteonwp Cloud

Transfer On Death Tax Implications Findlaw

Receiving An Inheritance From Abroad Special Considerations For U S Taxpayers Round Table Wealth

What Is Tennessee Property Tax H R Block

New Tax Laws Toward Investments In 2022 Coloradobiz Magazine